Arkansas’ revenue picture strengthened again in November as surging individual income tax collections pushed state totals well above expectations, according to a Department of Finance and Administration report released Tuesday.

Net available general revenue rose to $552.4 million, an increase of 7.8% from last November and 3.4% above the state’s monthly forecast. Through the first five months of the fiscal year, net available revenue stands at $2.82 billion, outpacing last year by $81.2 million and exceeding projections by $108.7 million.

Gross general revenue for the month reached $662.8 million, up 7.3% from a year ago and 3.4% above forecast. DFA officials said the growth was driven primarily by a sharp rise in individual income tax collections.

Individual income tax payments totaled $285 million, up 16.3% from last November and $22.3 million above expectations. The increase stemmed from an additional payroll cycle and stronger-than-expected return payments tied to the extended filing deadline of Dec. 3. Refunds also rose to $34.5 million, up $7.7 million from the previous year.

Sales and use taxes generated $303.4 million, a 2.9% annual increase but 1.3% below forecast. DFA noted the year-over-year comparison was distorted by a Thanksgiving-week timing shift in 2024 that had boosted collections by roughly $7.4 million. After adjusting for that anomaly, officials estimated underlying sales tax growth at 3.3%.

Corporate income tax collections slipped to $11.4 million, down $5.8 million from last November, though the figure still landed $2.6 million above forecast. Corporate refunds decreased slightly from last year.

Among smaller categories, tobacco tax collections remained nearly unchanged at $15.2 million, while insurance premium taxes climbed 11.5% to $31.7 million.

The Educational Adequacy Fund, which receives dedicated sales and use tax revenue, collected $62.6 million in November, with a net deposit of $60.8 million, a 1% increase from a year earlier.

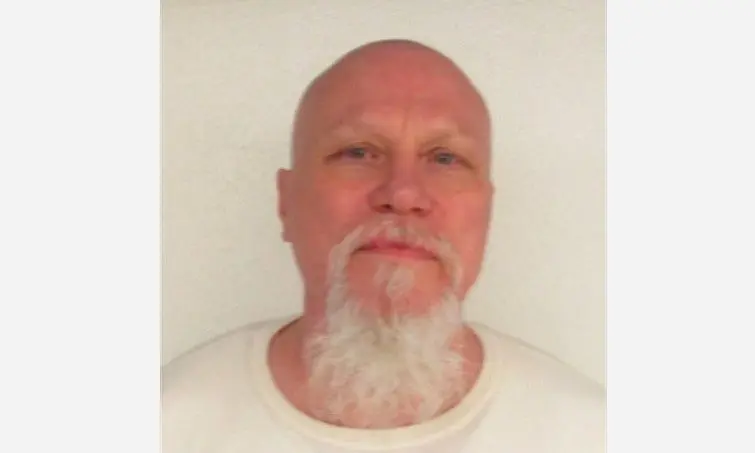

“November general revenue collection reflects the strength and stability of the Arkansas economy, with revenues increasing 7.8% over last year,” DFA Secretary Jim Hudson said in a statement. “Individual income tax collection significantly surpassed forecast due to the extended filing deadline and solid growth in wage withholding. As we approach the halfway point in Fiscal Year 2026, we remain in a favorable position at $108 million above forecast for the year to date.”

Have a news tip or event to promote? Email White River Now at news@whiterivernow.com. Be sure to like and follow us on Facebook and Twitter. And don’t forget to download the White River Now mobile app from the Google Play Store or the Apple App Store.

Get up-to-date local and regional news/weather from the First Community Bank Newsroom on Arkansas 103.3 KWOZ every weekday morning and afternoon. White River Now updates are also aired on weekday mornings on 93 KZLE, Outlaw 106.5, and Your FM 99.5. Catch CBS News around the top of every hour on 1340 KBTA.